Stop overpaying.

Start outperforming.

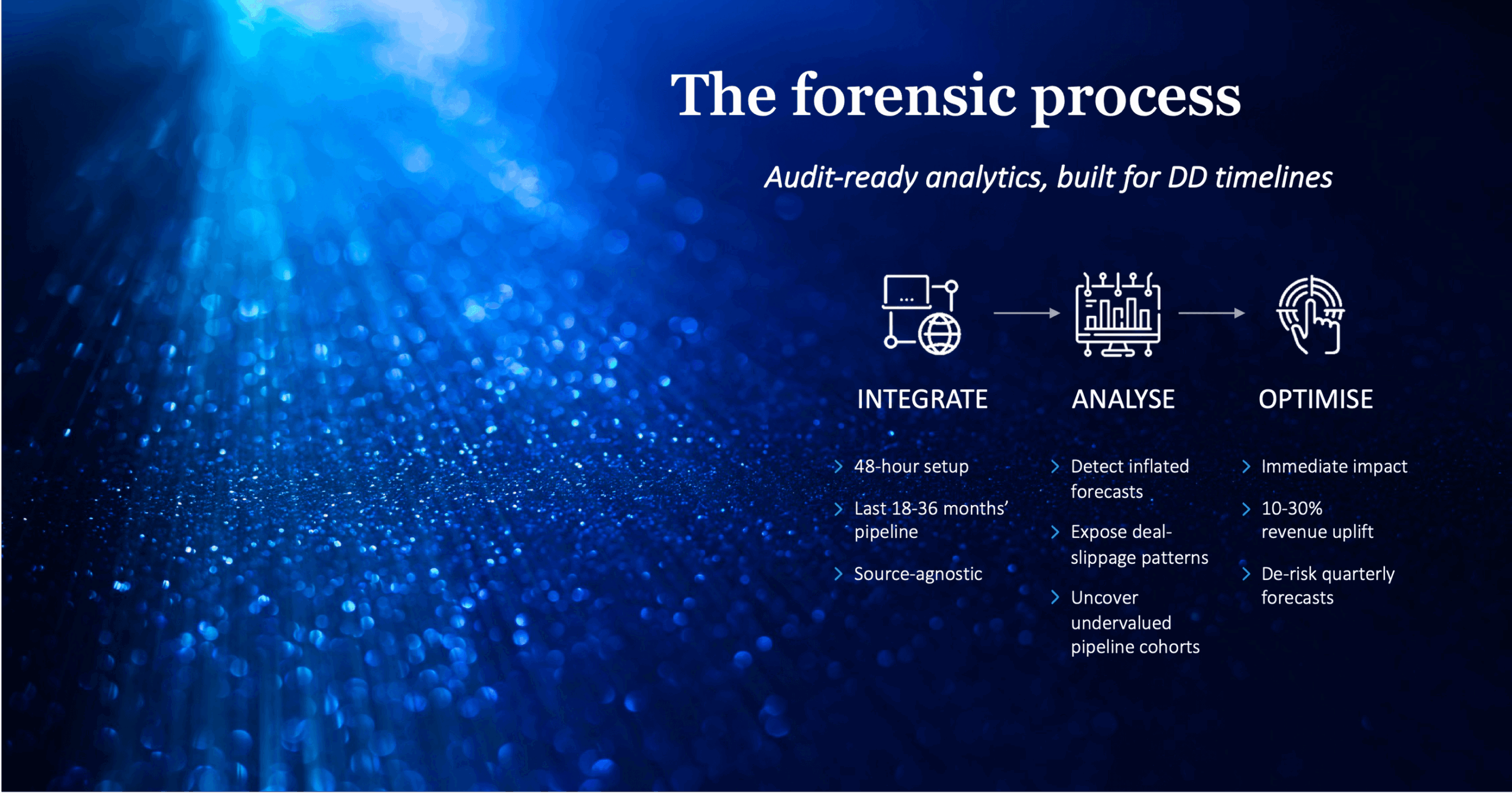

Quantify forward revenue before you buy.

Prove 10-30% uplift before exit.

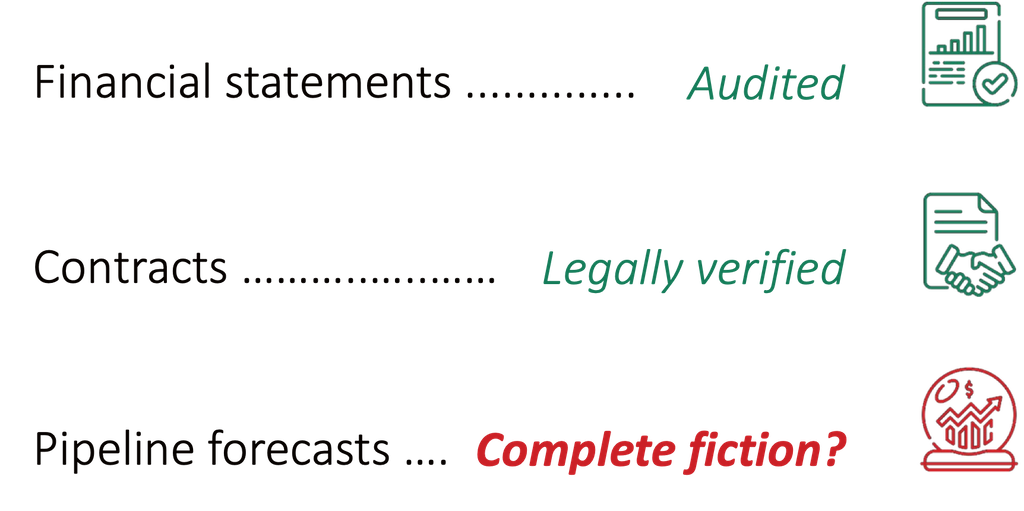

Pipeline forensics replace sales optimism with statistical evidence –

revealing what's probable, what's inflated, and when revenue will actually land.